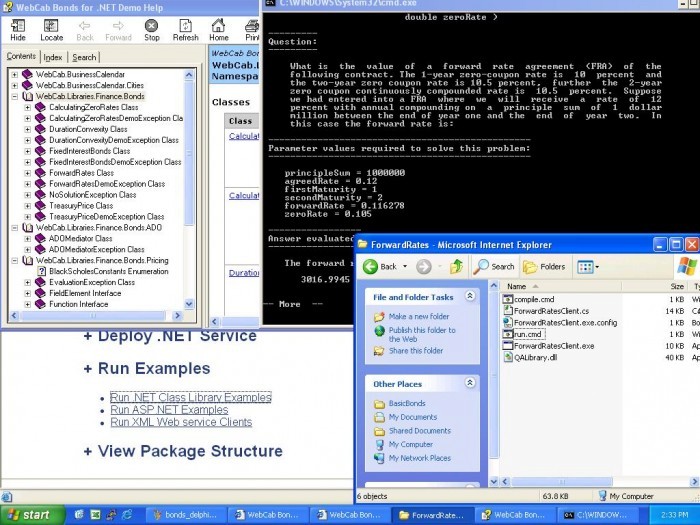

3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity. This product also has the following technology aspects: Extensive Client Examples (C#, VB.NET, C++.NET,...) ADO Mediator Compatible Containers (VS 6, VS.NET, Office, C++Builder, Delphi)

Publisher description

3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury bonds, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity. General Pricing Framework offers the following predefined Models and Contracts: Contracts: Asian Option, Binary Option, Cap, Coupon Bond, Floor, Forward Start stock option, Lookback Option, Ladder Option, Vanilla Swap, Vanilla Stock Option, Zero Coupon Bond, Barrier Option, Parisian Option, Parasian Option, Forward and Future. Interest Rate Models: Constant Spot Rate, Constant (in time) Yield curve, One factor stochastic models (Vasicek, Black-Derman-Toty (BDT), Ho & Lee, Hull and White), Two factor stochastic models (Breman & Schwartz, Fong & Vasicek, Longstaff & Schwartz), Cox-Ingersoll-Ross Equilibrium model, Spot rate model with automatic yield (Ho & Lee, Hull & White), Heath-Jarrow-Morton forward rate model, Brace-Gatarek-Musiela (BGM) LIBOR market model. Price Models: Constant price model, General deterministic price model, Lognormal price model, Poisson price model. Volatility Models: Constant Volatility Models, General Deterministic Volatility model, Hull & White Stochastic model of the Variance, Hoston Stochastic Volatility model. Monte Carlo Princing Engine: Evaluate price estimate accordance to number of iterations or maximum expected error. Evaluate the standard deviation of the price estimate, and the minimum/maximum expected price for a given confidence level. This product also has the following technology aspects: 3-in-1: .NET, COM, and XML Web services - 3 DLLs, 3 API Docs,... Extensive Client Examples (C#, VB, C++,...) ADO Mediator Compatible Containers (VS 6, VS.NET, Office 97/2000/XP/2003, C++Builder, Delphi 3-2005)

Related Programs

Price Interest Derivatives in .NET/COM/WS App

General Pricing EJB Framework.

General Pricing Java API Framework.

Mondo Bonds 1.0

Get ready for some fast-paced number bonds.

Calculate virtually all types of interest